Sample Council Tax Bill

Here you can see a sample Council Tax bill, if you hover over the numbered points you'll be able to read an explanation of each part of the bill helping you to better understand it. If you can't see the handy pop-up tips, you can read them here.

This is the date the bill was issued

This is your account number you will need to tell us this if you have to contact us about your bill

This is the name and address of the person registered to pay council tax

This is the address of the property that the council tax bill is for. This may be different to the address the bill has been sent to

This is the council tax band that the Valuation Office Agency have given to this property.

These are the charges for the council and the fire and police authorities. Each shows the amount of charge and the percentage increase compared to last year

These are the charges for this property. This will include any reliefs, discounts, reductions, disregards or premiums which are due

This is the total amount which is due to be paid for the year

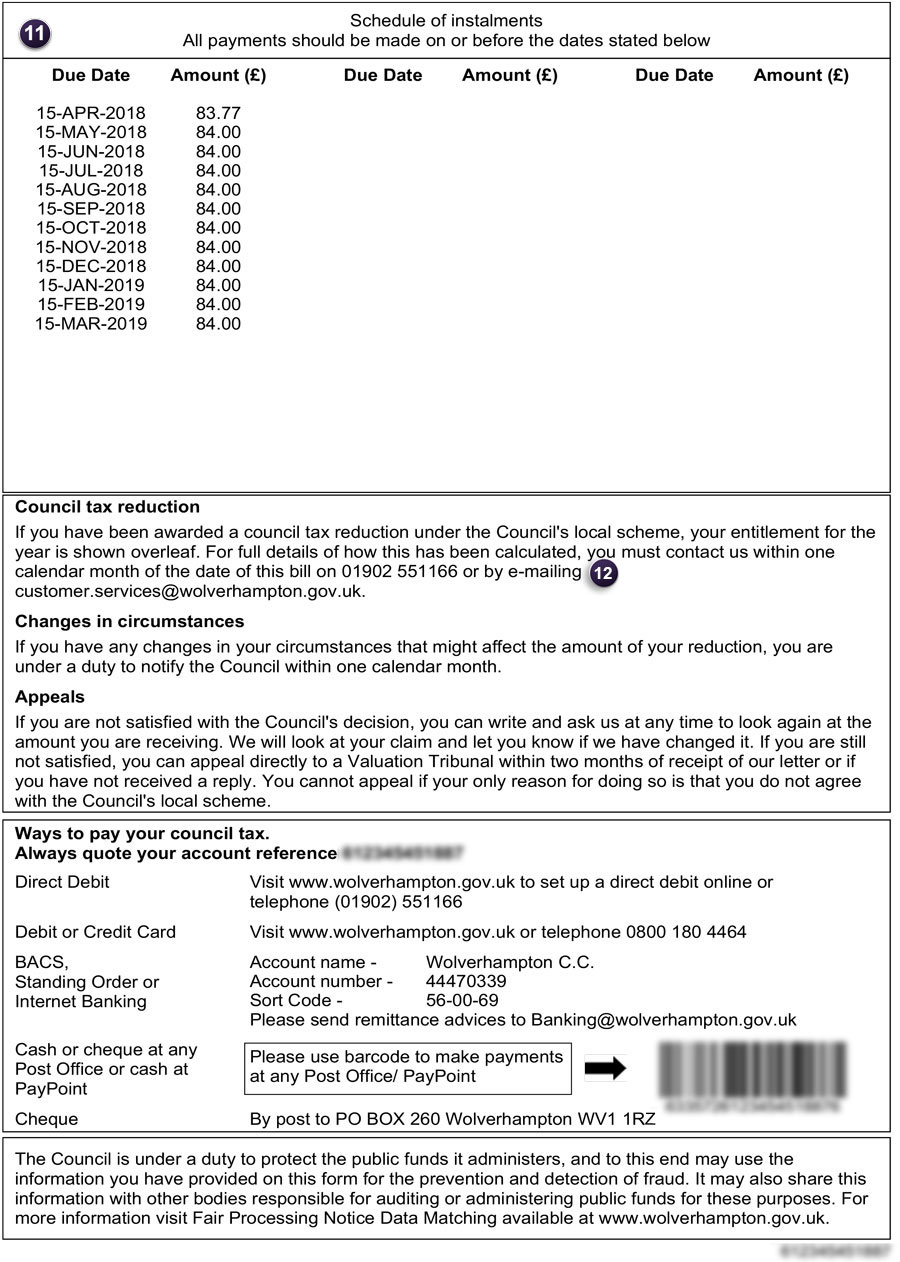

If you pay by instalments this shows how the instalments should be paid

If you have any amount which is still outstanding from your last bill it will show here. Please note any payments made after the date shown here will not have been taken into account

This details the amounts to be paid and the date each payment is due

Please press option 1 for housing benefits who will be able to answer your query

Council Tax Bill - Key to numbered features

- This is the date the bill was issued

- This is your account number you will need to tell us this if you have to contact us about your bill

- This is the name and address of the person registered to pay council tax

- This is the address of the property that the council tax bill is for. This may be different to the address the bill has been sent to

- This is the council tax band that the Valuation Office Agency have given to this property

- These are the charges for the council and the fire and police authorities. Each shows the amount of charge and the percentage increase compared to last year

- These are the charges for this property. This will include any reliefs, discounts, reductions, disregards or premiums which are due

- This is the total amount which is due to be paid for the year

- If you pay by instalments this shows how the instalments should be paid

- If you have any amount which is still outstanding from your last bill it will show here. Please note any payments made after the date shown here will not have been taken into account

- This details the amounts to be paid and the date each payment is due.

- Please press option 1 for housing benefits who will be able to answer your query